prince william county real estate tax due dates 2021

Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county supervisors took. First Half Real Estate Taxes Due Treasurers Office June 15.

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Provided by Prince William County.

. May 9 2022 - Tax Sale ends at 200 pm. New Applications for Tax Relief for Elderly Due. Successful bidders must wire the total amount due for all.

Prince William County real estate taxes for the first half of 2020 are due on July 15 2020. 2 nd half 2021 real estate tax bills were due december 6 2021. March 23 2021.

Opry Mills Breakfast Restaurants. By creating an account you will have access to balance and account information notifications etc. In fiscal year 2021.

The first monthly installment is due July 15th. Payment by e-check is a free service. Prince William County Real Estate Tax Due Dates.

4 2021 a 10 penalty is applied and. 300000 100 x 12075 362250. The due date for 2nd half 2021 real estate taxes is december 6.

Prince William County Real Estate Tax Rate. 3 the amount of the installment is past due. There are several convenient ways property owners may make payments.

The second and all subsequent installments are due on the 5th of each month. Estimated Tax Payment 2 Due Treasurers Office June 30. The tax rate is expressed in dollars per one hundred dollars of assessed value.

Prince William County Virginia Sales Tax Rate Property Taxes Prince Georges County MD Arlington County. The real estate tax is paid in two annual installments as shown on the. The new due date is february 3.

The tax rate is express in dollars per one hundred dollars of assessed value. Prince william county tax collector va The county is proposing a decrease in the residential real estate tax rate from. The board voted 7-0 in a straw poll vote to reduce the countys proposed real estate property tax from 1125 to 1115 per 100 in assessed value a 1-cent decrease.

To help businesses impacted by the economic impact of COVID-19 the County has extended the Business Tangible Personal. Yearly median tax in Prince William County. Second-half Real Estate Taxes Due.

When are property taxes due in Virginia County Prince William. How will i recieve my pets license and annual renewal notice. All successful bidderspurchasers will be notified by e-mail by 5pm.

Personal Property Taxes and Vehicle License Fees Due. Restaurants In Matthews Nc That Deliver. All you need is your tax account number and your checkbook or credit card.

Business Personal Property Filing Deadline Machinery Tools Filing Deadline February 15 Tax Relief for the Elderly and Disabled Mobile Homes Application Due Date. To help businesses impacted by the economic impact of COVID-19 the County has extended the Business Tangible Personal BTP Property tax filing deadline from April 15 2021 to May 17 2021. 13 rows July 1.

The new tax rates are effective as of January 1 2021 and. Prince William County personal property taxes for 2021 are due on October 5 2021. You can pay a bill without logging in using this screen.

A convenience fee is added to payments by credit or debit card. Stewart prepares new push for data center. Board of Equalization Appeal Deadline for Real Estate Assessment.

Prince william county real estate tax due dates. Purchase a Subscription. Prince William County Real Estate Tax Rate.

If the real estate taxes for the second-half of 2020 are not paid on or before Feb. FOR ALL DUE DATESif a due date or deadline falls on a Saturday Sunday or Holiday the due date or deadline is the following business date. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed value of 300000 dollars is calculated as. Prince William County Chair Ann Wheeler is seeking an updated budget proposal with no increase in the countys real estate tax rate due to. First-half Real Estate Taxes Due.

For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed.

Fairfax County Officials Ask Prince William County To Reconsider Pw Digital Gateway Proposals Dcd

Prince William Prosecutors Seek More County Funding Headlines Insidenova Com

2022 Best Places To Raise A Family In Prince William County Va Niche

Facility Event Rental The Prince William County Fair

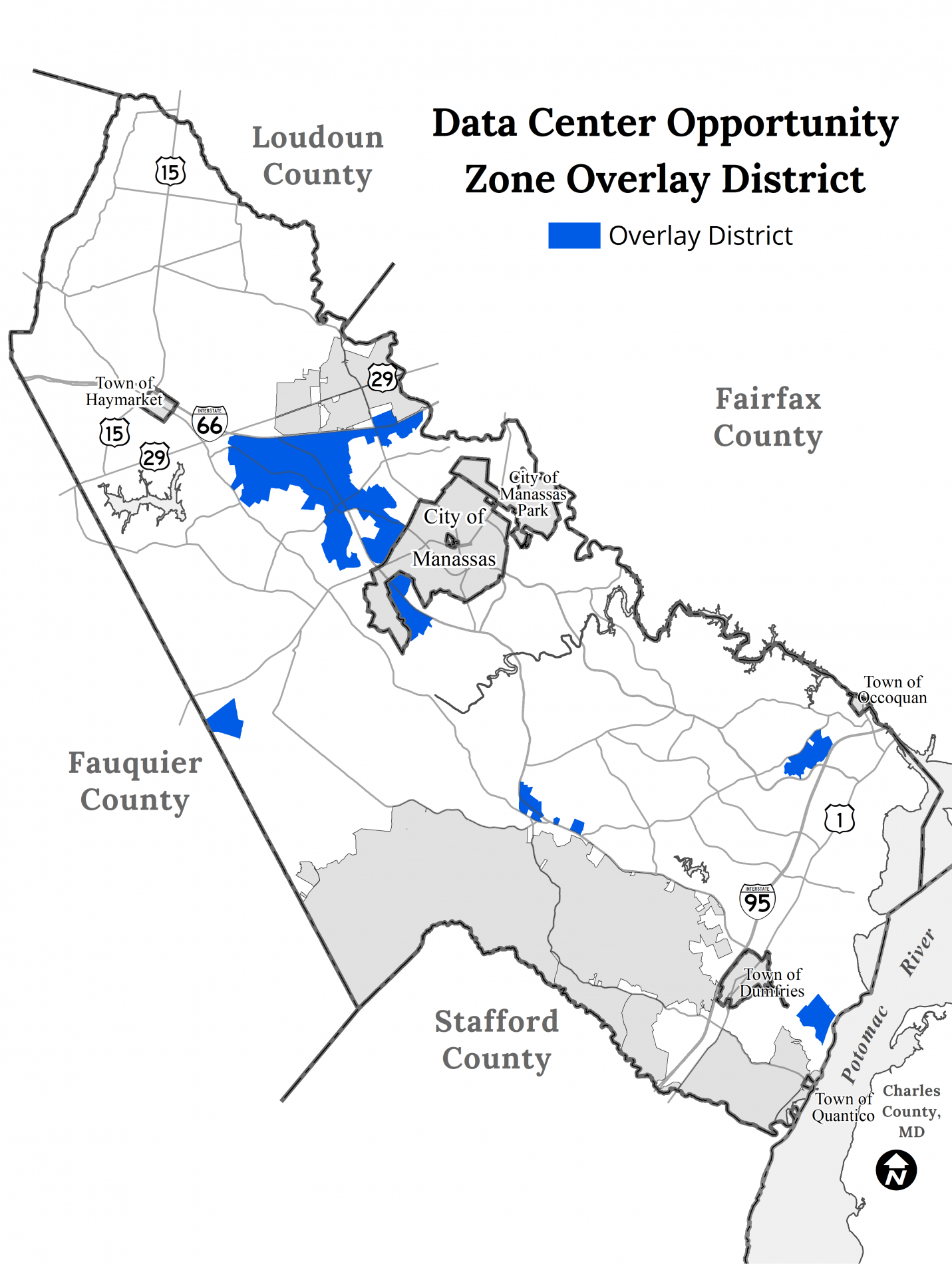

Data Center Opportunity Zone Overlay District Comprehensive Review

Prince William County Data Center Site Sells For 74 5 Million Dcd

Prince William County Housing First Time Homebuyer Program Youtube

Class Specifications Sorted By Classtitle Ascending Prince William County

How Healthy Is Prince William County Virginia Us News Healthiest Communities

Prince William Supervisors Dig In On Comprehensive Plan Update Headlines Insidenova Com

Prince William County Va Real Estate Market Realtor Com

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements